PRICE VOLATILITY AND RESOURCE DISTRIBUTION

The efficient distribution of economic resources depends on the efficiency of the price system, which signals where and how to allocate resources. Relative price changes have responded to, and continue to respond to the echo of, the Covid-19 shock to both demand and supply.

The CPI is a basket of many different prices, and very large changes in just a few prices with even small weights can show-up as a large increase in the CPI. For inflation to force a central bank into constraining action, a few relative price changes would have to broaden to all prices and threaten to accelerate. So far this is not the case. Relative price changes must be left to do their job, and the price changes required to rebuild supply efficiency must be allowed to flow-through even if it takes the measured CPI higher for a while.

Falling prices signal either falling demand or over-supply and potentially falling profitability. Rising prices signal either rising demand or under-supply and potentially higher profitability. The dispersion in prices across firms and sectors is the means by which resources are efficiently reallocated in times of intense change.

Research on the response of German producers to changes in demand, monitored through the summer of 2020, showed that firms most negatively affected by a decline in demand were more likely to reduce prices, and those that were positively affected were more likely to raise their prices. Interestingly, the same research showed that a negative supply response was more likely to generate upward pressure on prices.

Significant damage was done to the smooth production and distribution of both goods and services within in domestic economies and between all economies. This damage needs to be repaired, and so we should expect to see some very large changes in individual prices of the most affected sectors. And indeed, this is what we observe.

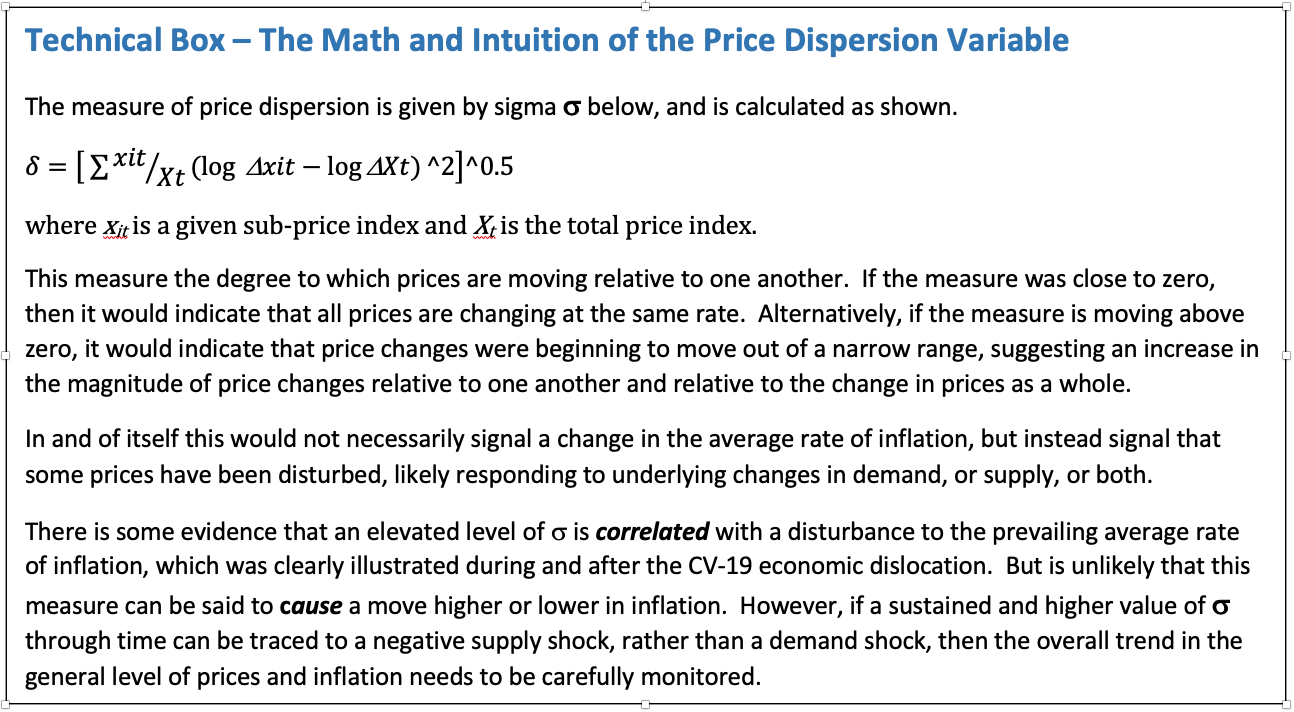

Using US CPI data, I have calculated a price dispersion variable to identify any unusual price activity through the Covid-19 lockdown-induced downturn. This price dispersion variable measures how much spread we see between the prices we are most interested in relative to the CPI as a whole as shown below.

The greater the value, the more widely prices are moving relative to each other and the overall CPI and relative to time. A spike suggests that all prices are moving more than usual, relative to each other, both up and down. As the chart below shows, there has been a significant and sustained increase in relative service price dispersion, with some prices moving over a very large range.

For example, airline ticket prices reflect the scale of the disruption to that industry, and similar volatility can be seen in the prices of social consumption services.

We want to know if there is greater than usual price change dispersion as it hints that there is an underlying churn in underlying resource allocation. Any firm or sector can collapse on any given day, but it takes time to recover resources and reallocate them.

We can see from the price dispersion measure that US service prices respond quite powerfully to large economic shocks. Clearly the Covid-19 shock was bigger than the disturbance rendered by the global financial crisis, eliciting much more relative price change and has lasted longer. It would seem that repairing the economy is taking longer to achieve.

Is the shock permanent or temporary? If the demand-supply mismatch is temporary. then it will likely have a transitory affect on overall prices, but if there has been a permanent negative supply shock and demand is left to run at a permanently higher level, then the relative price shock will become a general price shock and we will get higher inflation.

The chart left shows the persistence in the price dispersion variable and all items CPI, and a clear positive correlation between the two series is clearly seen. The fact that we see a spike higher in relative prices leading CPI higher should give us comfort that this is a large relative price event and not a general price event. On other words, this is not inflation that needs to be constrained, and relative prices must be left to do their job of hastening efficient economic repair. And central banks are doing just that: letting it run-through.

To restore supply potential in the social consumption sector, wages need to move higher to attract labour, and so prices will have to rise for some products and services. After a long period of sub-optimal demand, there is unlikely to be any profit cushion to absorb higher wages. And, many industries (cruise lines, airlines, for example) took on bridging debt to get through the crisis that they must now service, so one-time increases in prices should be expected.

Only the passage of time will reveal whether there has been a permanent loss of supply potential at a time when demand has been sustained by large fiscal transfers. If this proves to be the case, then strap yourself in as central banks will have to put the inflation genie back in the bottle. Given high government debt ratios and the need to keep debt financing costs down, even as the central banks are willing to act against inflation, they may not be as able to as we assume.

DISCLAIMER

The information included in this letter is believed to be accurate and complete, and comes from sources that we believe to be reliable. Spence Strategic Consulting Group Inc. makes no warranty as to accuracy or completeness of information or data.

Contents of this letter are neither intended to be nor constitute investment advice.

All rights reserved, not for recirculation or publication without author’s approval and consent.

Published by Spence Strategic Consulting Group Inc, 22 St. Clair E, Suite 1502, Toronto, Ontario. M4T 2S5.